The Art of Bankroll Management: Key Tips for Trading

Getting Risk Management Right

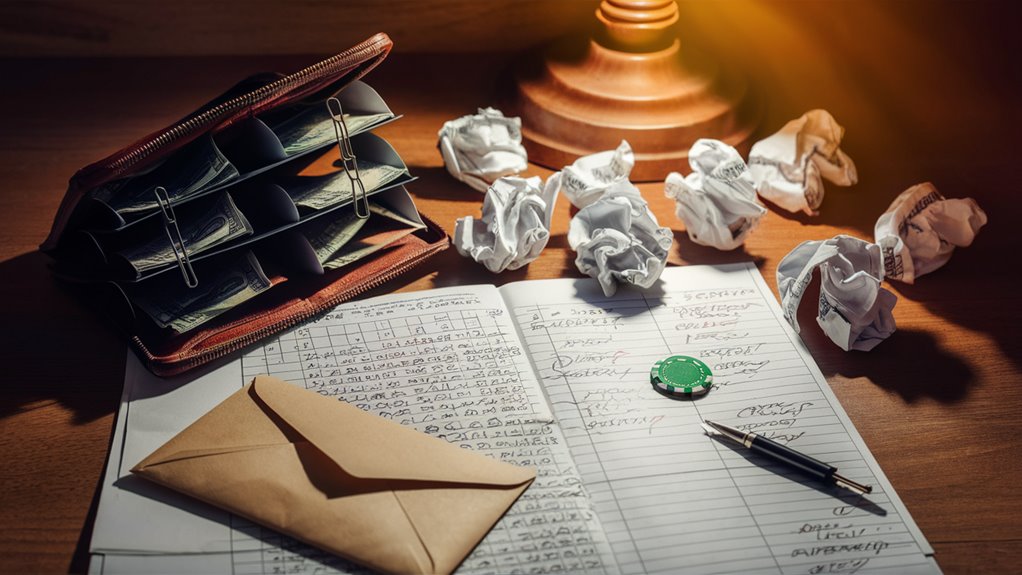

Bankroll management is the core of good trading using tried risk control steps. Knowing your risk level and using size rules builds a strong base for trading that lasts.

How to Set and Follow Size Rules

Using firm size caps of 1-2% per trade guards your money and grows your profit chances. A fixed unit style based on your total money, often 1-3 units per play, keeps risk steps the same over all your trades.

Smart Risk Control Steps

Stop-loss points are key to defend against big losses. When the market is wild, keeping these set end points stops you from making rushed choices and helps save your trading cash.

Keeping Track and Reviewing

Watching key trading points, including:

- Win rates

- Level of fall

- Risk-reward scores

- Money in each play

Keeping full trade logs lets you base changes on facts and fine-tune your plan.

Finding Your Way Back After Setbacks

If you find yourself losing often, cut your play sizes by 50% until you’re back to winning. This smart step lets you stay in the market while you get back your trust and cash.

Using Risk Management Like a Pro

Getting good at these bankroll rules sets winning traders apart by:

- Planned cash use

- Set play sizing

- Smart risk checks

- Regular results tracking

Knowing How Much Risk Works for You

Knowing Your Own Risk Level for Trading

Seeing Your Risk Level

Checking your risk wants is key for good bankroll steps. Start by seeing how you feel about possible losses. Watch how okay you are with losing some money – whether it’s 10% drops or 20% less money. Your reactions help show your own risk limit.

What Shapes Your Risk Level

Three main things shape your risk profile:

- Your money: How much cash you have

- Trading Know-how: Your past in the market

- Mind Set: How strong you stand in wild markets

Setting Your Risk Rules

Say Your Risk Caps

Find your highest loss level by picking the most you can lose in one trade day without going into panic. Set stop-loss caps at 50% of this to keep smart control and stop mood-based trading.

Risk Steps Change

Risk levels change with:

- More market time

- Changes in your cash

- New trading aims

Do risk checks four times a year to keep your trading rules up with market shifts and your own plans. This way, you keep a good risk-reward mix while looking after your main money aims.

Setting Clear Money Rules

Clear Money Rules for Trading

Firm Trading Caps

Risk management starts with setting solid cash limits when you trade. Three key caps build the base of smart trading: total bankroll cap, play size cap, and biggest loss cap per trade. These smart guards save your cash and block moves based on feelings.

Setting Your Trading Funds

The first move is to set your biggest bankroll – your total money just for trading. This sum should be apart from emergency money and personal savings. A set trading account keeps clear money lines and stops using too much.

Play Size Tactics

Play sizing is key for risk steps. Using a safe 1-2% rule per trade saves cash while growing long-run growth. This way makes sure your money is safe from big drops from any single trade.

Stopping Big Losses

Setting a big loss cap sets a firm end point for Top Set Operator plays that aren’t doing well. A 25% stop-loss line is a hard rule for any single trade. Keeping to set end points saves you from big losses and keeps your money steady.

Writing Down Your Trade Plan

Good traders always write down and check their set boundaries. Putting these caps in a fixed trade plan keeps up your drive and answerability. Checking these rules often makes sure they stay right with your big plans and risk level.

Understanding Betting Units

A Guide to Betting Unit Care

Betting Unit Basics

Three main parts make a winning betting unit plan: percent-based use, unit standard use, and growing scale. The best start is to use a set betting unit of 1-3% of total bankroll, making a balanced base that saves cash while keeping big play sizes. With a $10,000 bankroll, normal units would be $100-300 per bet.

Making Unit Rules Same

Making units the same sets a system that stops mood-based choices in your betting plan. Turning all bets to units not to money sums makes a big mind change needed to keep smart betting ways. This way turns money into unit picks, making it clear in bet checks and risk steps.

Scaling up Smartly

The 1-2-3 unit plan makes a clear structure based on how sure you are:

- Normal plays: 1 unit use

- Good chances: 2 unit use

- Very sure plays: 3 unit top use

This layered betting way sets clear limits that block too much play while growing possible returns on likely good bets. The firm 3-unit top acts as a key risk tool, no matter how sure you feel in any bet.

Risk Steps

- Never go over 3 units per play

- Keep unit size the same

- Base uses on how sure you are

- Follow the smart growing rules

- Keep your bankroll safe with firm limits

Getting Back After Losing

Smart Steps After Trading Losses

How to Get Over Losses

Right steps after a string of losses are key for a trading life that lasts. The start of good getting-back lies in smart play sizing and good bankroll care. Rather than rushing to cover losses, using a planned way helps keep you in trading for long.

Setting New Risk Rules

Making new risk steps are key for a good get-back plan. After hitting three losses in a row, cut play sizes by 50% to protect what’s left of your cash while you keep playing the market. This smart cut lets traders:

- Save trading cash

- Keep mind cool

- Stay in the market with less risk

- Build trust with smaller plays

Scaling Back Up

After getting two wins in a row at a lower size, start to bring back your usual play size over three trades. This careful way stops too early big risks while showing your trading plan works.

Pick High Chance Trades

In get-back times, go for high chance trade setups with:

- Clear marks

- Strong base facts

- Set risk rules

- Clear profit aims

Watching Your Moves

Keep full get-back time facts writing down:

- Trade steps

- Win rates

- How long get-back takes

- Find patterns

- How well strategies work

This fact-based way lets you keep making your get-back steps better and spots weak spots in your trading ways.

How to Keep Records

All You Need to Record in Trading

Musts in Trade Writing

Systematic trade tracking is key for good trade result checks. A full record system should note every deal through detailed sheets, writing down big info points including start and end spots, play sizing, and win/loss facts. Every trade start must note why you made that move.

Facts and Feelings in Trading

Result Points

Trade facts should cover both numbers and how you feel:

- Win rate percent

- Average trade wins

- Biggest fall levels

- Risk-reward counts

- Market state looks

- 먹튀검증커뮤니티

- Mind state notes

- Outside trade things

How to Write It All Down

Use a three-level writing plan:

- Daily trade log with each deal facts

- Weekly result checks gathering all results

- Monthly plan check to see pattern worth

Keeping Records Online

Trading book apps make it easy to gather and look at data. Set auto trade data adds to cut mistakes and keep data right. Do usual saving to make sure records last and give full past looks.

Making It Better

Watch links between market states and trade results through planned record looks. Find repeat patterns in trading acts to make plans better and help make choices. Keep full notes of outside things that change trade results for full fact looks.

Last Words

The Skill in Bankroll Handling

Good bankroll care is key for a long life in betting. A planned way with smart steps and firm actions makes sure you can stay in casinos and sports betting for long.

Key Bankroll Steps

Smart bankroll plans need strong systems that keep your money safe while growing possible wins. By setting clear betting units and keeping full result checks, players make a base for smart choices.

Risk Steps at the Core

The start of good money safety is in:

- Setting firm bet caps

- Keeping full records

- Sticking to set limits

- Using stop-loss steps

Keeping It Long

Focus on lasting growth over quick wins. Your betting plan should match your risk wants and money aims. This way helps you last through ups and downs and keeps your cash in tough times.

Better Tracking Ways

Pro bankroll care needs:

- Usual result looks

- Detailed deal logs

- Planned cash use

- Set risk checks

Getting these right makes a strong base for long wins in any betting scene.